Young Professionals’ Choices in Day-to-Day Spending Can Impact Financial Future

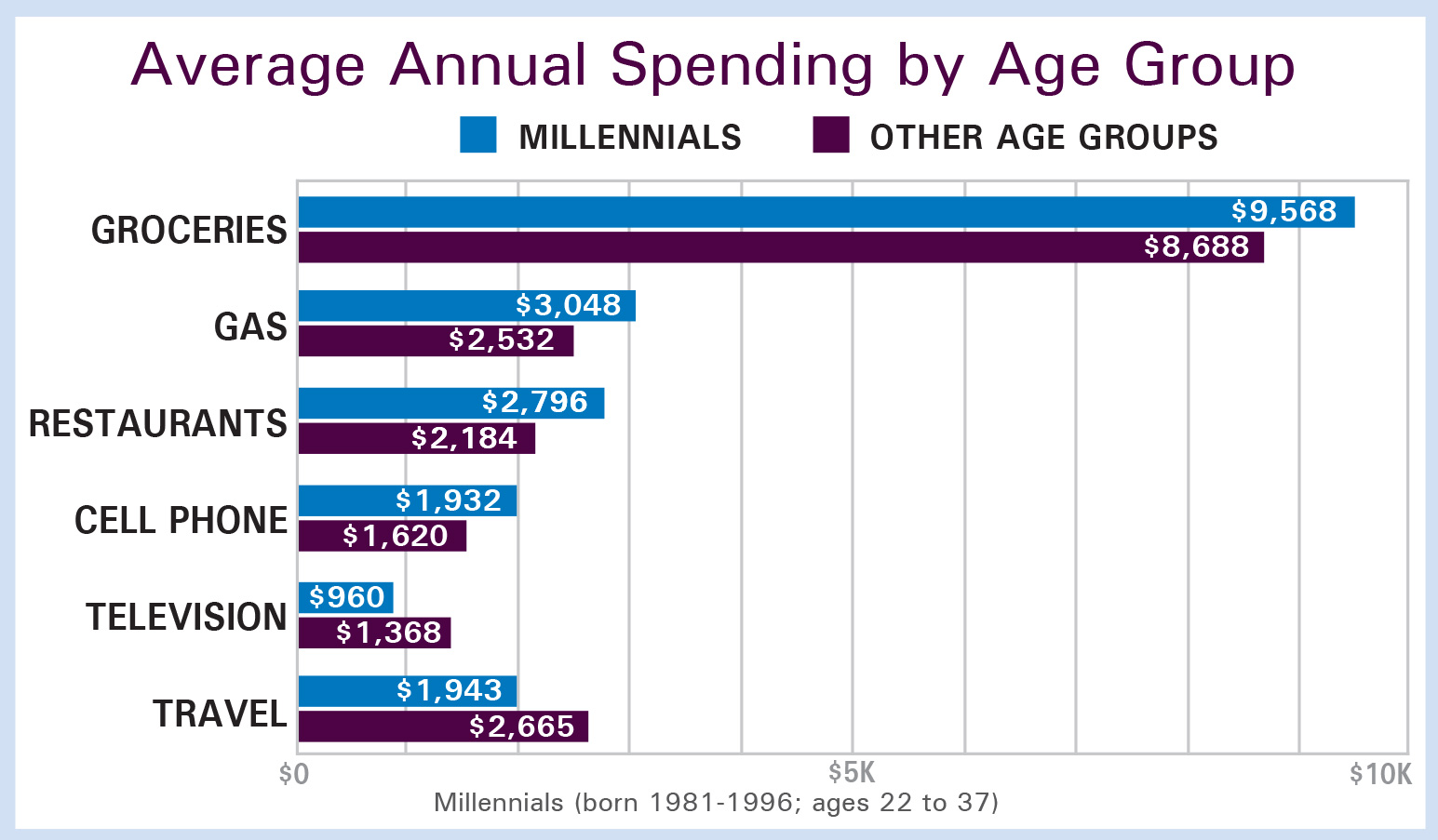

Spending index research conducted by Princeton Survey Research Associates revealed that young professionals are spending significantly more than their elders in four of the six categories examined in the survey.

The survey confirmed that many adults in the 22 to 37 age group were falling victim to common daily spending vices that can lead to larger financial struggles. Already faced with the largest student loan debt of any generation and housing costs that exceed the long-held standard of 30 percent of their income, young professionals are sometimes hard pressed to make ends meet.

Spending Index, July 6-9, 2017, conducted by Princeton Survey Research Associates International. Telephone interviews with a nationally representative sample of 1,002 adults living in the continental United States. The margin of sampling error for the complete set of weighted data is plus or minus 3.9 percentage points.

All told, this age group spends an additional 15 percent, or over $2,300 per year more, when compared to other generations. According to an annual financial index,[1] eating out is the number one item that Americans spend their money on, with 24 percent of the family budget being dedicated to restaurants. This is true for every age group, with the young professionals’ weekly tab for eating in restaurants or getting takeout averaging $233 a month. An average of $53 a week is spent on eating lunch at restaurants.

A crucial step in making sure that young professionals start off building a sound foundation for their financial future is developing a plan and establishing investment goals. Balancing immediate wants (e.g., eating dinner out) with long-term benefits, like retiring early, can help guide day-to-day financial choices.

A good way to get a better understanding of where the money goes is to keep track of every expenditure during one month. Seeing the total figures will help you assess where to economize so money can be redirected toward investing.

At River Wealth Advisors, we understand that on-the-go young professionals want instant access to the details of their investment portfolio and/or financial plan. We have the technology to accommodate you via our online portal, which gives you instant access to your portfolio and the financial planning tool MoneyGuidePro.® Through the planning tool, you are able to create a budget, track your goals, create and update your financial plan, and actively adjust your investment goals. Another feature available to you, “The Play Zone,” allows you to virtually try out unlimited combinations of options, testing each one to see how it impacts the probability of the plan’s success. Talk with us about getting started.

[1] Financial Well-Being Index: American Workers was conducted online within the United States by Harris Poll, December 2016.